What is Dividend Investing

Most of us are familiar with dividend investing. It’s very simple. A dividend is a distribution of money that a company pays to its shareholders, typically on an incremental basis. And most dividend investors typically take that cash and reinvest it into different dividend paying companies. That’s what causes a lot of compounding in the market.

Dividend Investing Portfolio Example

My portfolio, for example, which I started recently, has already earned a small amount of money in dividend income. This is money that I could keep and spend on groceries, or it’s money that I could use to buy more dividend paying companies and further increase my income. And that of course is exactly what I’ve been doing. I’ve been reinvesting all the dividends I’m paid back into my portfolio along with contributing new capital from my full-time job. And over time the amount of dividend income will grow substantially. The dividend income rises and grows as you add more capital.

Passive Income Through Dividends

And as I reinvest dividends, I’m moving towards what’s called passive income, which is the end goal of my financial journey. Passive income is often talked about as something too good to be true, that it doesn’t really exist. And in some cases, people refer to it as a hoax, saying that you shouldn’t even consider it because it’s not something real. But others have created enough passive income that they don’t actively have to work. Warren Buffett is one of those people.

If you don’t find a way to make money while you sleep, you will work until you die.

— Warren Buffet

Making money while you sleep is passive income. Warren Buffett could have just said if you don’t find a way to make passive income, you will work until you die. Now, I don’t necessarily want to be in a situation where I’m forced to work until I die. I enjoy working, but I like to be doing it on my own terms, and that’s where passive income comes into play.

5 Different Ways Dividends Make Money

Today I would like to share with you 5 different ways that dividend stocks make you money. Some of these are not as obvious as they seem even if you’ve been dividend investing for a long period of time or you’re a complete novice, and you’re just looking into the strategy. I think this list will be helpful either way to both the experienced investor and the novice.

Dividends = Income

This is the most basic, fundamental way that a dividend stock makes you money. And I think most investors and especially dividend investors are aware of this. Of course, a dividend stock pays you income. That income is called a dividend. There’s not much of a difference in this situation between income and a dividend. They’re basically the same thing. The dividend that they pay is part of the total return of that stock.

For example, around 40% of the total returns of the entire stock market is from dividends. If you look at just the price change of a dividend stock without factoring in the dividends that it’s paying, that’s similar to looking at a rental income property as just having capital appreciation and not factoring in the rental income you’re getting. To accurately do analysis on a dividend stock, you need to factor in the dividends being paid.

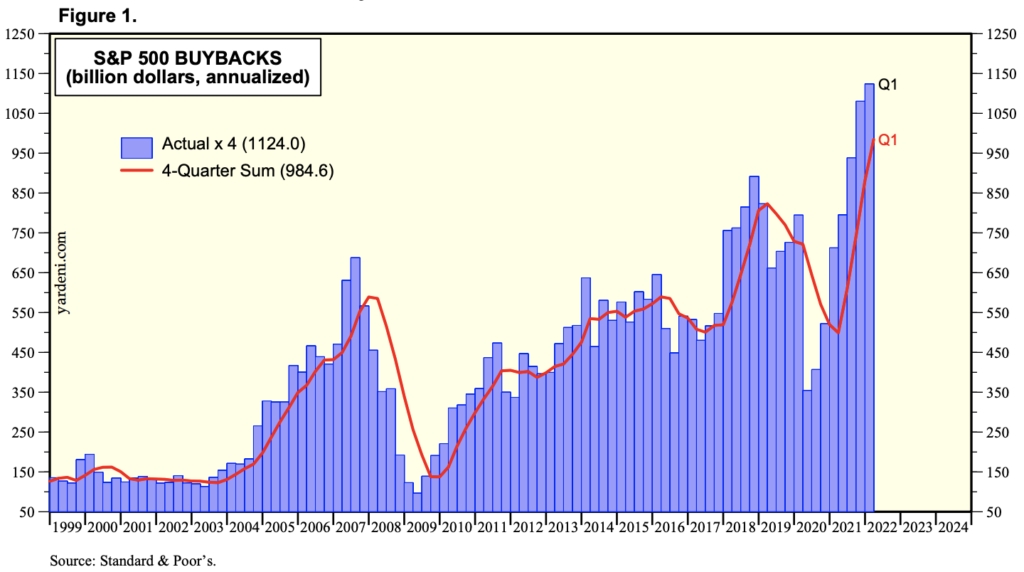

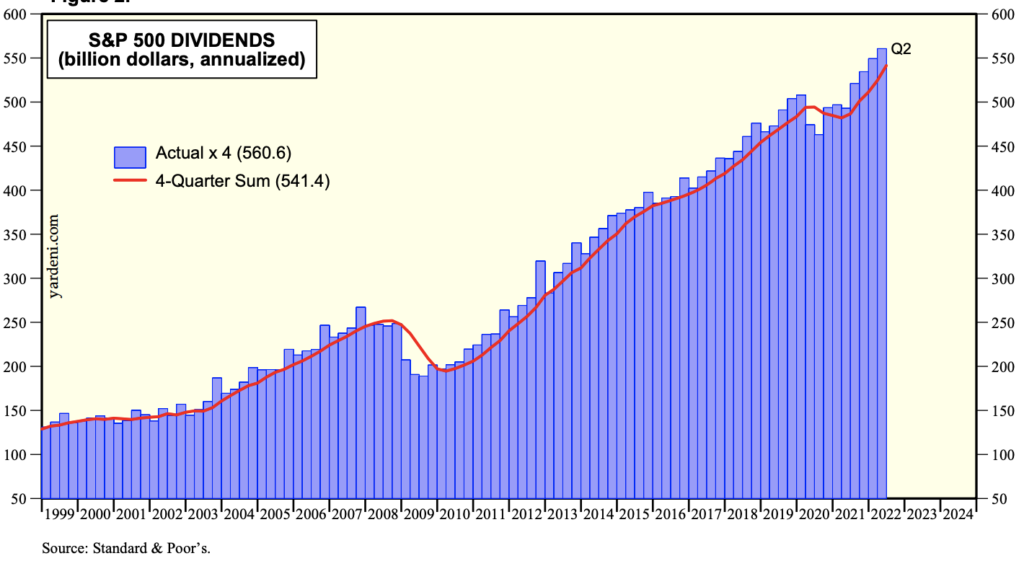

Dividend paying stocks are far more predictable than any other return in the market. Buybacks are simply not that predictable. Companies will start buyback programs and stop them frequently. Dividends on the other hand are incredibly consistent.

This is a chart showing the amount of dividends being paid by the S&P 500 on a quarterly basis. Notice that it’s not volatile at all. It went down slightly in 2008 during the Great Recession, but then it started to climb gradually. And even the current day, it’s been much more consistent than buybacks. Dividends overall are the most reliable way of getting returns in the market. They’re far more consistent than buybacks, and they’re even more consistent than their earnings growth of a company.

Simply put, paying dividends, which is a large part of the total returns of the market, and it’s a very predictable form of income. It’s the most predictable way of earning money in the market.

Reinvested Dividends Buy More Shares and Increase Income

When you’re paid a dividend, you can do whatever you want with that money. You could spend it on entertainment, or groceries, or traveling, or you can do something called reinvesting it, which is where you gather your dividends and you buy more dividend paying stocks with that money. Reinvesting introduces the concept of compounding.

And this is a difficult concept to understand. Compounding has mathematical consequences that are very difficult for our brains to wrap around. We want to think linearly. We want to think that money goes up in a straight line, not that it will have huge, explosive growth. But compounding introduces this new element that’s incredibly important in investing. You can see this in the net worth of Warren Buffett’s life. He made most of his net worth after a long time in investing, and his net worth grew exponentially. Just google for images of “warren buffett age and net worth”.

That’s the result of compounding with dividend investing. A reinvested dividend buys you more shares of dividend paying companies, which increases your income even further. And greater income generates even greater income, which generates even greater income. That is the power of compounding and that leads to incredible amounts of wealth over long periods of time.

Dividend-Paying Companies Raise Dividend Payout Over Time

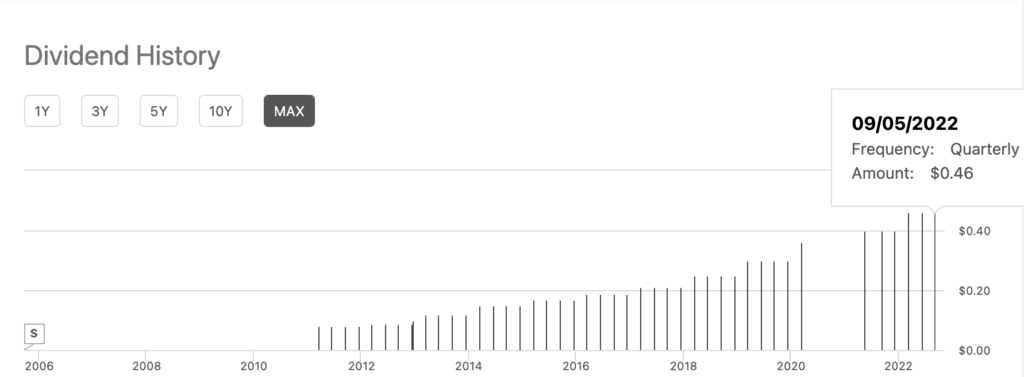

Companies tend to raise their dividends that they pay overtime. This creates income growth in and of itself even with no reinvestment. An example of this would be Texas Roadhouse. This is a dividend paying company that I own in my portfolio. Texas Roadhouse is unique in some things, but it’s not unique in this fact. They grow their dividend over time. For example, if you bought shares of this company in 2011, your dividend that you would be paid on a quarterly basis is 8 pennies. You would be getting $0.08 per quarter without doing anything. In one year they raised that to $0.09, then the next year to 12 cents, then 15 and then 17 and then 19. So, in just a couple of years, the income that you are getting back in 2011 was already doubled in 2016. That’s what this company did for the shareholders, but they didn’t stop there. In 2017, it went to 21 cents, $0.25. Thirty cents, 36, and then 46 cents.

Every year they’re increasing the dividends that they’re paying to shareholders. So again, if you bought this company back in 2011, you would have been earning 8 cents. And just by holding on to it with no reinvestment, without adding any additional capital, that 8 penny dividend per quarter has grown to $0.46. Now, if they had reinvested these dividends back into the company all along, they’d own a much greater share count. So not only would they have their dividend income increase by five times, but they’ve also own more shares which increases their dividend income even further.

Texas Roadhouse, again, is not unique. In this fact, Costco’s dividend has increased from $0.10 to $0.90 over the past 16 years. There’s a lot of companies that have been around for a long time that continually increase the dividend income. Johnson and Johnson is one of them. You hold this company and your income grows over time with no reinvestment necessary.

Most decent dividend paying companies will grow the amount of income overtime without any interaction on your behalf. And in most cases, they’re growing their dividend income at double or triple the rate of inflation. This past year has been unique where inflation has been a challenge to keep up with. But even then, dividend income has outpaced inflation. Dividend paying companies raise their dividends overtime and that increases your income without any effort or interaction on your behalf.

The Company Grows Revenue, Market Share and Earnings, Causing the Price to go Up

As companies grow. Generally speaking, and especially if they grow their earnings, the stock price will go up as a result, even if they are paying dividends. We can take the example of a company like Home Depot and this could be swapped out for many different examples. Home Depot over time has generally grown its earnings. That earnings growth has caused capital appreciation growth over the past 10 years. Home Depot’s stock price has gone up 417% while paying out a big dividend the entire time. You combine those two together and you get a very impressive market beating total return. And this is not unique for Home Depot. Many different good quality dividend-paying companies have this in common.

In fact, research analysis from Morgan Stanley has mentioned this a few times. They have a paper called Dividend Stocks Tend to Outperform. And in this analysis they go over many of the different reasons why dividend companies tend to do better overtime than non-dividend paying counterparts. With that they summarize that most dividend paying companies that incrementally raise their dividend also have very strong fundamentals. They go hand in hand. For a company to raise a dividend over time it has to generate actual cash. It can never grow a dividend over long periods of time while not generating growing amounts of cash. They also reference other studies related to this earnings growth and the fundamentals of the companies.

Like a recent study from Factset showing that dividend paying stocks outperformed their nonpaying counterparts by a dramatic amount. From 1991 through 2015, non-dividend paying stocks earned just 4.18% return per year, while dividend paying stocks significantly outperformed with 9.7% average annual returns. And of those companies that pay dividends, the ones that can raise their dividends overtime outperformed at even a greater extent, outperforming 17 out of 23 years.

And this has been the case for a while. Many of the boring dividend paying companies that have been around for 50 years are the type of companies that outperform the rest of the market. Just look at Johnson and Johnson, Estee Lauder, Home Depot, Pepsi, Costco, Church and Dwhite, Hershey. A lot of these boring dividend paying companies not only pay a higher amount of income, but they also have better capital appreciation. They have better earnings growth.

Left-Over Cash for Buybacks Causes EPS Growth For Dividend Stocks

Most dividend stocks are so profitable, especially the top ones that you see most dividend investors investing in that they will also have leftover cash for buybacks, buybacks which reduce the amount of shares outstanding, causing significant earnings per share growth. Also, buying back shares makes it easier for the company to raise the dividend because there’s less shares outstanding, so they can increase the dividend without having to pay it out to so many shares.

Lowe’s is a good example of a company doing this. You could also use Home Depot if you want as well. Lowe’s and Home Depot are good dividend paying companies. They have a very long history of growing their dividend over time, checking all the boxes so far. But Lowe’s also does share buybacks. They reduce the number of shares outstanding dramatically over a long period of time.

And again, this does two things for the shareholder and the company. For one thing, reducing the number of shares outstanding helps grow the EPS of the company. The growing earnings per share of the company make it so that the stock price appreciates. Not only does reducing the share count cause the EPS to go up and also causes the price to go up, but it also makes it so that the company has less shares outstanding to issue dividends. And, therefore, it makes it easier for them to raise the dividend overtime.

Summary

Is Dividend Investing Worth It?

To summarize, the first three ways that dividend stocks make you money, all of it specifically centered around the dividend. The companies pay you a dividend, which is an important and predictable part of total returns of the stock market. If you reinvest those dividends, you’re introducing the strong concept of compounding, which will enhance your returns dramatically over time. And then of course the companies will increase their dividend payments overtime even without you reinvesting. But if you do all three of those, your dividend income should grow dramatically over long periods of time. The nice thing for dividend investors.

So, there you have five ways that dividend stocks make you money, three of which are related specifically to the dividend itself, two of them related to capital appreciation, but all of which add up to a great total return.

There’s going to be a lot of different ways that dividend stocks help earn you money and protect your wealth. One of them is lower volatility overall. One of them is better support during market sell offs and so on and so forth. There’s a lot of good things about them that’s not highlighted here, but I think that these five reasons are a very good summary of some of the basic ways that they make you money with no effort on your part.