Today, I want to share with you my passive income strategy which is one of the best investment strategies in the entire stock market, especially during times of recession.

I am going to share with you some juicy new data about what happens to dividend investing in a recession. It’s going to be awesome, especially if you’re a nerd! Also, there are no courses I want you to buy, no mastermind groups to sign up for, and no email lists to join.

My Portfolio At M1 Finance

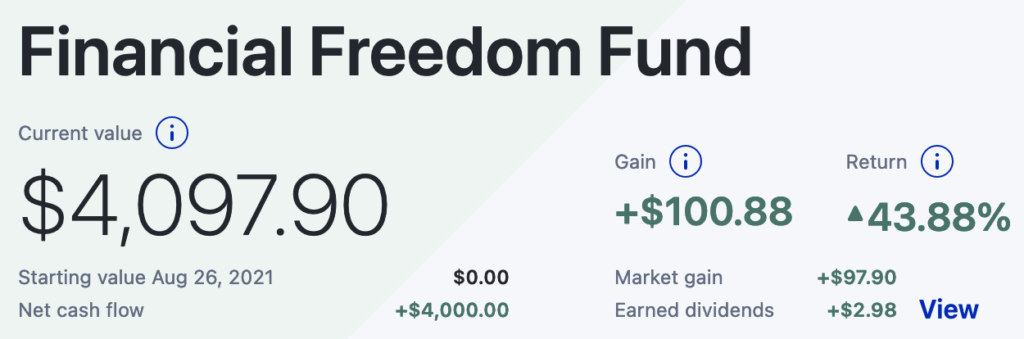

I have a brokerage account with M1 Finance which I use for dividend investing. I invest the majority of the money that I make into my portfolio most of which, by the way, comes from frugal living. I’m not an investing guru, but luckily investing is way easier than the gurus like to make it seem.

This year I am up a moderate amount as you can see depicted below:

How Much Money Needed To Live Off Of Passive Income?

As a general rule of thumb, if you want to know how much money you need in a portfolio to live off of the dividend income, you take the amount of money that you want to make per year, so let’s say it’s $40,000 a year. Then, you would take this number and multiply it by 22 or by 28.

So, if you multiply 40k by 22 you get $880,000. If you multiply it by 28 you get $1.12 million dollars. That’s the range that your portfolio needs to be to generate $40,000 per year.

You also need to have your dividend yield which could be between three and a half and four and a half percent across your entire portfolio. If I assume that my dividends will grow at the exact same rate that they have been, and if I continue reinvesting all those dividends every single year rather than spending them on random things I don’t need, it could boost my growth by a few percentage points per year.

Now let me share with you what happens to all this dividend income in a recession. It’s really really cool!

So, let’s talk about dividends because one of my investment goals is to retire on dividend income alone. Remember, dividends are paid out from the cash flow of profitable companies. But sometimes I worry that what if I retire in a recession where there is no cash flow? What would happen to my dividend income? What’s going to happen to my nest egg?

Dividends Are Less Volatile

I want to share with you some data that shows what happens to all this dividend income in times of distress. What I found is that dividends are a lot less volatile than the broad stock market. Meaning, that when there are times of hardship and there is a recession, dividend stocks tend to fall less hard. But when there are times of economic prosperity and growth, they also grow a little bit less.

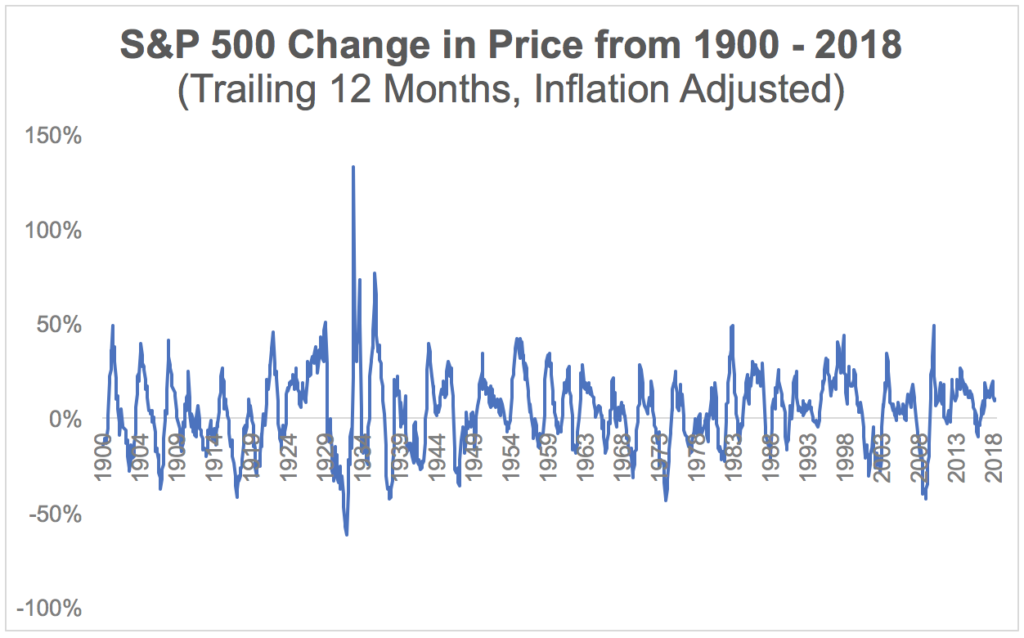

Here’s an example of what the stock market looked like between the years 1900 and 2018:

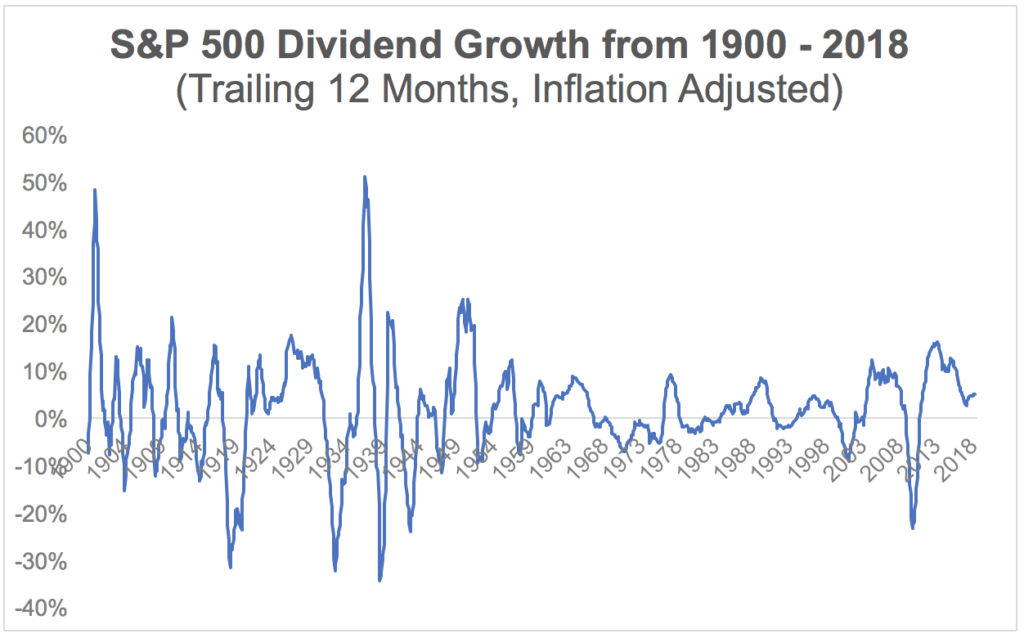

All you have to pay attention to are these peaks and valleys. And here’s what the dividend growth looks like from that same period:

You can see that the dividend growth data has fewer peaks and fewer values, which means it’s a lot smoother. Now, I also realized that in the last century a lot has changed in society and the stock market.

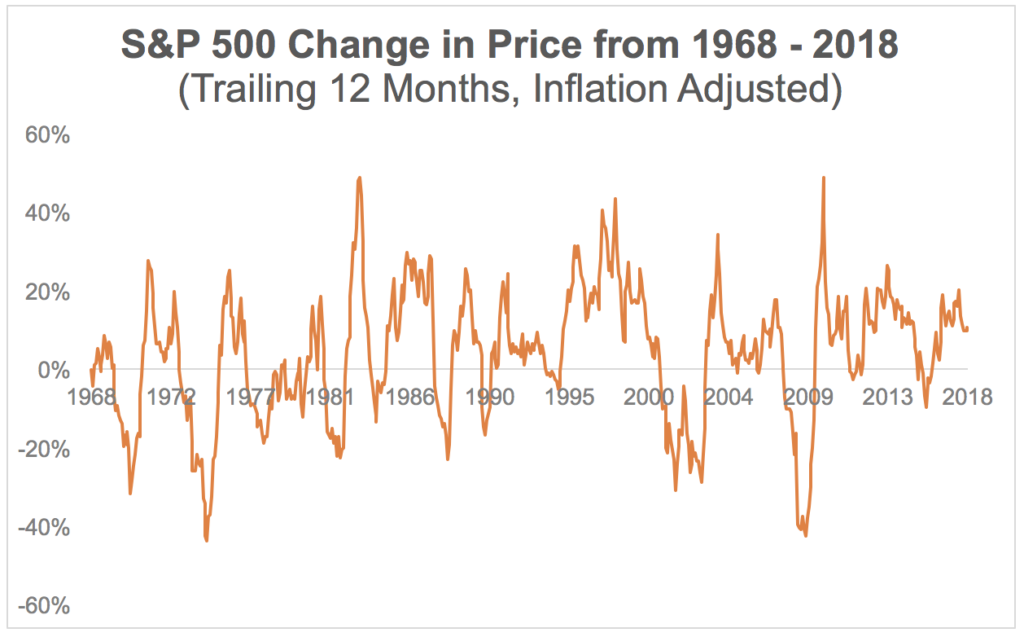

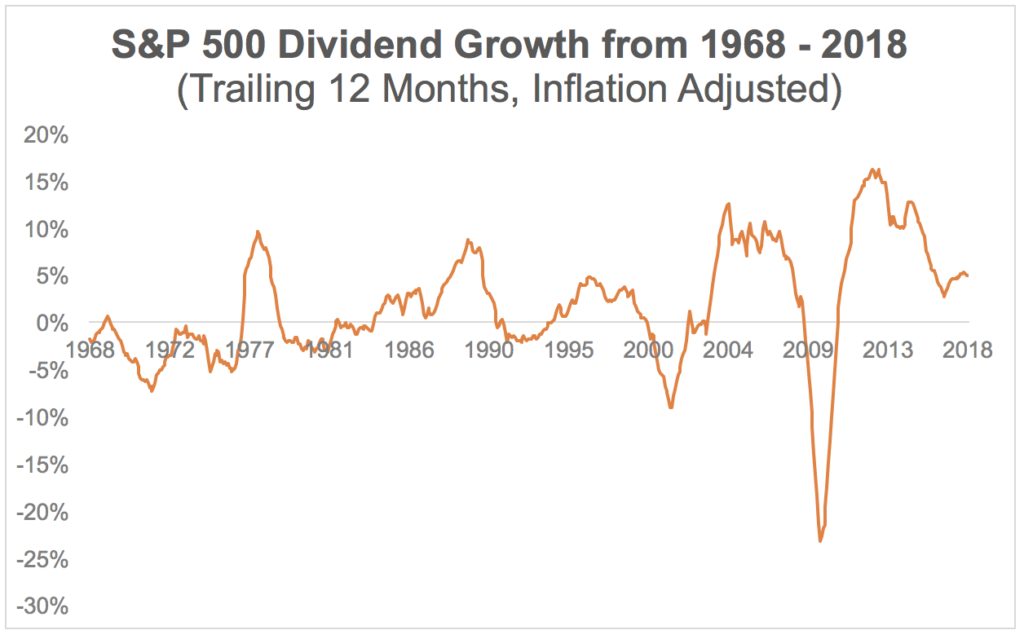

So, let me compress that same time frame and show you that same thing from a little bit more of a recent time. This right here is the stock market from 1968 to 2018:

And this right here is dividend growth from that same period:

The data shows that the price of stocks is twice as volatile as the growth in dividends. It completely makes sense. Because in the short term no one knows exactly what the short-term direction of a company is, which is why the stock prices fluctuate as much as they do. But, we know that in the long-term companies tend to become more profitable, and people that hold on to their stocks get rewarded in the form of dividends.

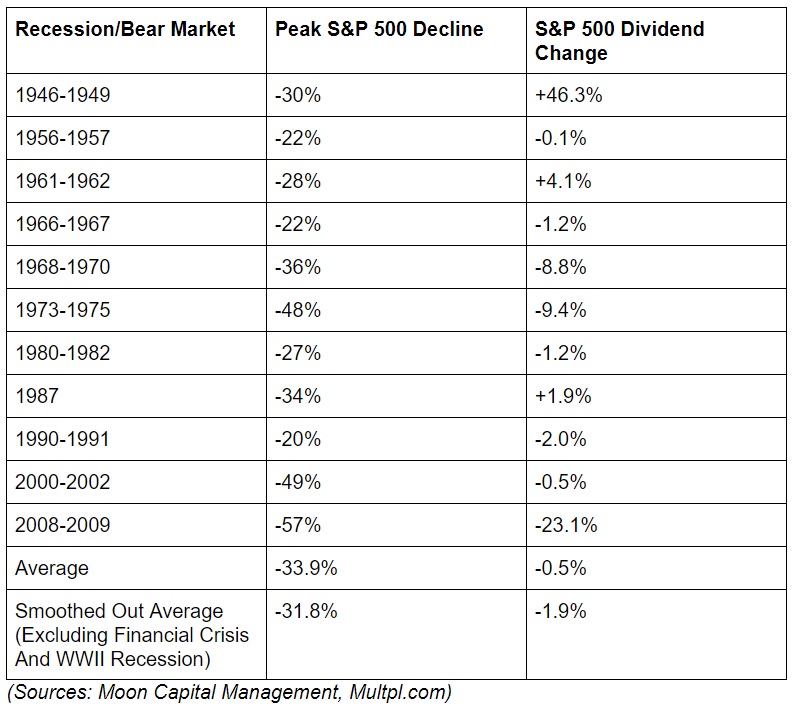

Now, if we look at times of a recession the stocks have dropped more than 20 percent.

You can see in each of these cases the change in dividends is nowhere near how much the stock market went down. In some cases, the dividends paid out went up instead of going down. The point is that dividend investing can be a great way to invest in the stock market during volatile times like we have right now, where the market has no idea where it wants to go. This is why we have these crazy ups and downs.

What Are The Pros And Cons Of Dividends?

Now the downside I would argue to dividend investing is that you will make less of an overall return if you were to compare it against something like investing in a broad market index fund like VTI or VOO.

Dividends will make less, but I will argue that dividends are a lot less stressful the downside though. It’s that you need a lot of money invested in your portfolio to live just off of your dividends. But the upside I would argue is that it taught me to live way below my means and invest most of my income. So, those are some of the pros and cons, but now let me share with you the only things you’ll ever need to know when investing in a recession.

Fun Investing Truths

All right, so here are some fun investing truths. I’m sorry if you’ve heard some of these before, but I feel like now more than ever, when the economy is in a recession, people tend to make some desperate moves. They YOLO a majority of their money into meme stocks, hoping to double and triple their money and then they end up losing most of it.

Consistent Is Key In Investing

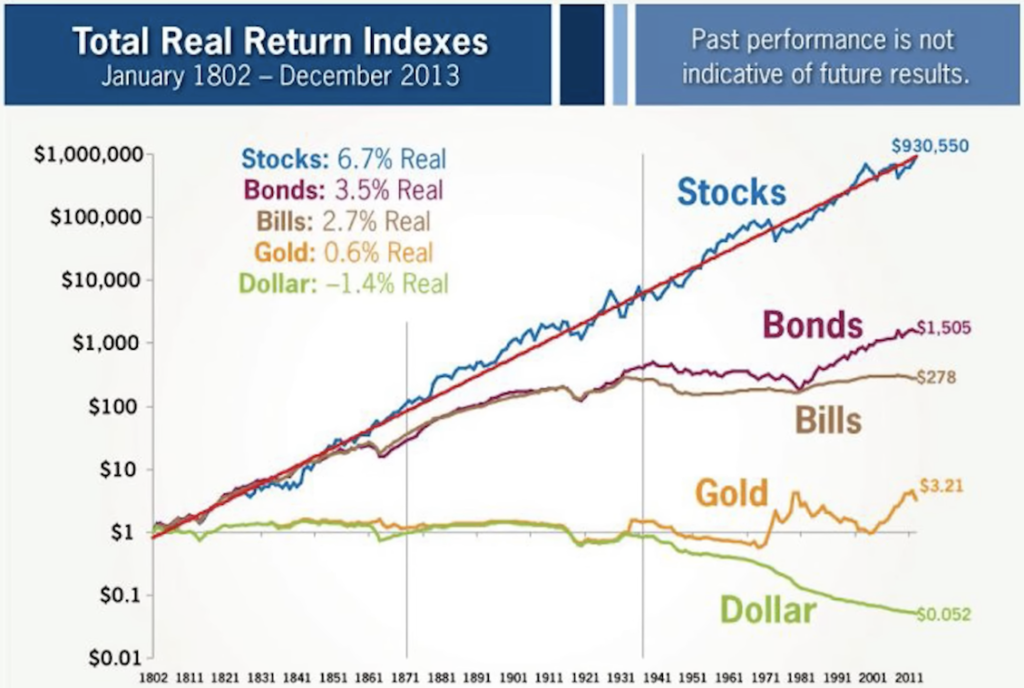

That’s why the first simple truth is this graph right here, which shows over the last 200 years the stock market has outperformed everything else in terms of real returns.

I like to compare the world of investing to the world of fitness, nutrition, and weight loss. I’ve known people who spend thousands of dollars in search of the magic pill that will make them lose weight and that’ll make them fit, but the reality is it just means going to the gym, setting good habits, eating healthy, and doing that consistently over and over again. And the same is true of investing.

There are no magic pills. There are no stock courses you can buy. No magic money managers that’ll make you more money. No stock picks that people can suggest to you that are going to 10x your money in a short amount of time. Because it doesn’t exist, unfortunately. Most people won’t figure that out until they’ve spent decades looking for the answer.

Average Investor Makes 2%

That’s why the second truth is that the average investor will only make two percent on their money. It is way less than the stock market is supposed to make. To prove that this is true, there’s a recent article that came out by CNBC, which shared that only one in four Americans think that right now is a good time to invest in the stock market. And that’s because most people’s idea of good investing is to buy low and sell high. So, they’re always trying to time it. And that’s why 65 percent of Americans are saying that they’re leaving their money out of the stock market in fear of investment losses.

That proves that most people have no idea what good investing looks like. There is no good time to invest in the stock market. It’s all the time, consistently, just like there is no good time to go to the gym. It’s all about consistency.

Markets Never Go Up In A Straight Line

The third truth about investing is that investing never goes up in a straight line like you would imagine it to. In some years you have to be prepared for the market to drop by as much as 30, 40, 50, and even upwards of 80 percent in some years. It’s crazy, but that’s how it works and during a 20-year period of investing it averages out to be between 8 to 10 percent growth. But because people don’t know that, they get so scared and they panic, when they see a 30% drop. They sell everything and they sit out of the market, which is a really bad idea.

There Is Always A Reason To Sell

And the fourth truth of investing is that there will always be some smart-sounding reason to sell, whether it’s a recession, interest rates going up, a currency crisis, or someone telling you to sell.

Like right now, a good reason to sell is maybe the Chinese economy would fall apart or a chart that compares stocks from today and stocks to 2008.

It implies that the stock market would need to lose another 63% from today’s levels and that sounds scary. It sounds like it makes perfect sense, but chances are if you went through with it, and you sold your entire portfolio, here’s what might happen.

Over a 20-year period, ending on December 31st, 2021 the S&P500 returned an average of 9.5 percent per year. But if you missed the top 10 best days in the stock market, your return would have dropped to 5.3 percent. That means missing those 10 crucial days, you would have lost about half as much as you deserved and that means that sometimes doing nothing is literally the best thing you could do. So, remember that the next time you hear someone tell you why they sold their stocks because it’ll sound like a good idea, but chances are it won’t be.

Now, I have a couple more investing truths that I think are even better.

Politics Do Not Matter

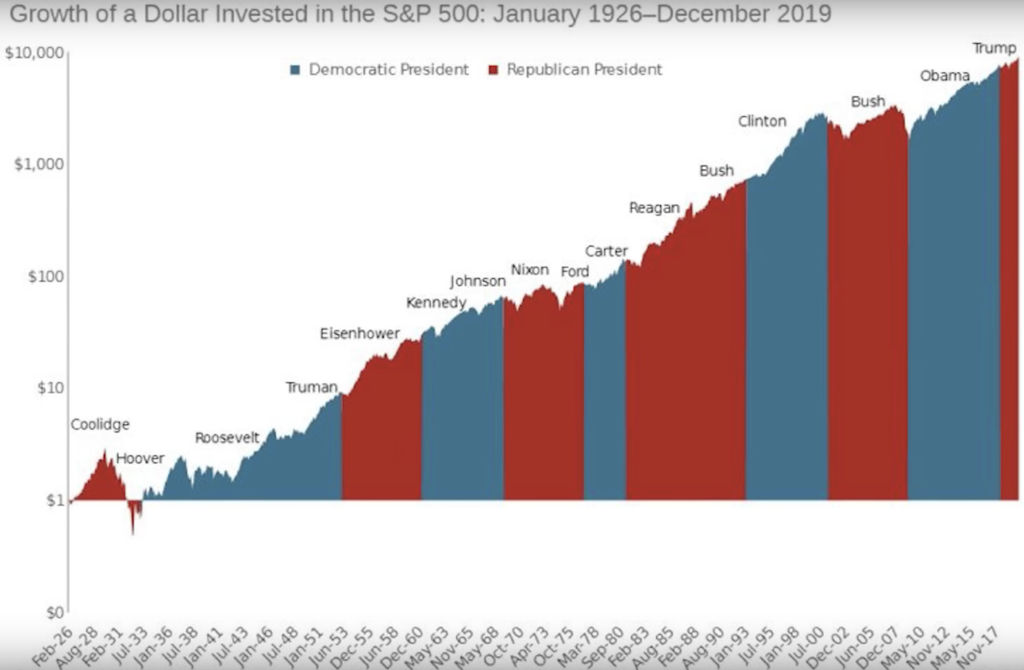

The fifth truth about investing has to do with politics. Some people seem to think that the stock market does better when the republicans are in control of the government. And some people seem to think that it does better when the democrats are in office.

The truth is that the stock market goes up regardless of who’s in power because the economy is so much bigger than any presidential or political influence on it. And that’s why the stock market goes up regardless of who’s in power. The point is, don’t try to use the political cycle to time the market, because in the long term it doesn’t work.

Ignore Economists

Alright, the sixth truth about investing is to ignore economists. That’s because there’s a little funny physics joke about economics that goes like this. The first law of economics is that for every economist there exists an equal and opposite economist. The second law of economics is that they’re both wrong! And that’s why I don’t make my own predictions about the market. I try to make sense of it, and I show you how I’m investing. But I’m not going to make my moves based on what I think will happen even if I think I’m right. Because it’s not worth missing those top 10 crucial days.

Start Early And Invest Now

Now, the seventh truth of investing is that the earlier you start, the faster you can get to that 20-year period and hopefully end up with more money than you started with. And more time is on your side to compound your money into millions to retire with. Those are all the objective truths that people just can’t argue with, but there’s also an eighth truth about investing.

There Is No Best Strategy

That’s a personal truth to you and this is where the internet fights and bickers over which investment strategy is the best. The truth is there is no best. They all cater to a different kind of person and a different kind of goal.

Real Estate

For example, if you’re somebody who likes to invest in real tangible assets, you can touch and feel. You might want to be a real estate investor.

Stock Market

But maybe you’re somebody who doesn’t want to manage tenants, and you don’t want a full-time job, so, maybe, you want something more passive. So, you invest in the stock market instead. So, you buy broad market index funds, because you heard that over the long term, they produce the best results. So, you buy VTI or VOO and you hold on to them for more than 20 years. That’s a cool strategy too.

Mutual Target Date Funds

But maybe you don’t want all that volatility and you don’t trust the market as much, so, you buy mutual target date funds which over time shift from stocks to bonds as you get older.

Bonds

Or maybe, you’re already older and you want to protect your wealth, because you’ve already accumulated a lot of money, so you buy bonds exclusively and that’s all you stick with.

Or maybe, you feel better about investing in the stock market because you want to be paid that cold hard cash and you’re okay with giving up a couple of percentage point returns because you feel like this is a much better result for you.

Business

Or maybe, you don’t trust the stock market at all so you invest all your money in yourself in building yourself a business.

Crypto

Or maybe, you want to invest in alternative assets because you don’t understand any of that stuff, so you want to buy some crypto.

The point is, there’s no right answer and it depends on the person and the situation and that’s why finance in investing is called personal finance. Because it is personal to all our personalities, our goals, and the things we’re comfortable with. There is no best. At a certain point, it just becomes subjective anyway.

Let me share with you a quick few highlights of what happened in the market last week.

So, the biggest story that happened last week is that the housing market is finally starting to cool down with existing home sales falling 6% and 63,000 homes that went under contract. That is about 15% of the entire real estate market now getting canceled. And that is the fastest rate of cancellations.

Now, nationwide inventory levels are starting to climb and that’s why the NAHB, the national association of homebuilders, just recently declared that the housing market is already in a recession and falling fast. This is why their confidence metric is down for the eighth straight month in a row.

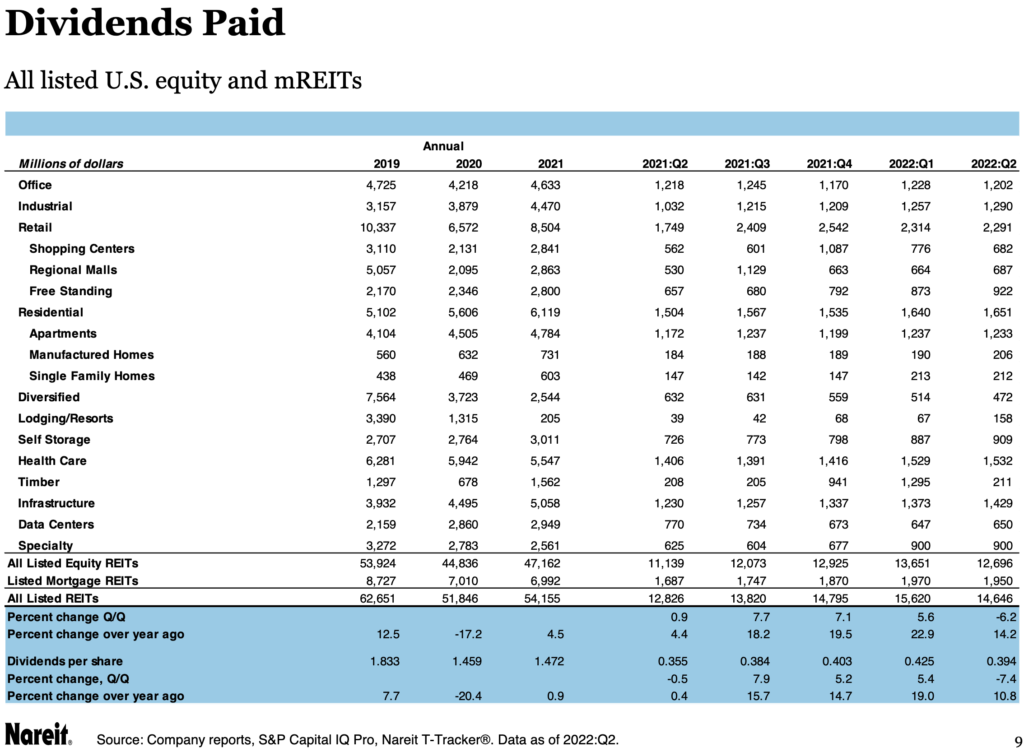

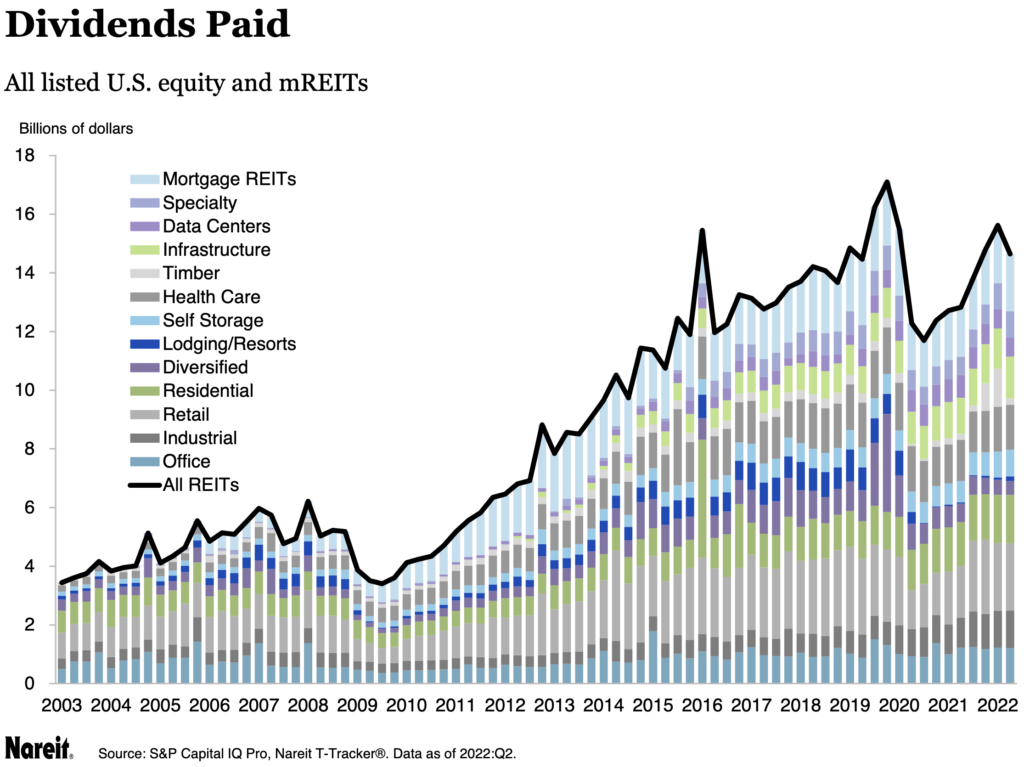

Also, last week the market found out in the latest FOMC minutes meeting with Jerome Powell that the Central Bank has no plans to slow down interest rate increases. It means the real estate market is probably going to suffer a little bit more this year. What’s crazy is that dividends paid out in the residential sector or REIT stocks are actually up more than 10% this year.

And mortgage-backed REITs dividends have increased more than 15% this year.

That means that even though we’re in a technical recession, dividends in relation to the real estate market are still up, proving my point. Dividends can be a really great way to diversify your income even in tough times which is why I’m still reinvesting in them regularly.

What is your strategy when it comes to investing? Feel free to drop me a line below!