The main difference between Binance and FTX is that Binance offers a large selection of cryptocurrencies available for trading, zero-fee Bitcoin trading fees, deep liquidity, and live customer service chat. On the other hand, FTX is very much comparable in all these categories and has established itself as the new premier crypto trading exchange.

Binance, or FTX? It’s a tough choice. One is a legendary heavyweight and the other is a rising star. In this post, I’ll go over the pros and cons of each exchange, comparing them side by side, hoping it will assist you in picking the right exchange.

History of FTX and Binance

Binance

So, who is Binance? Well, they are the number one exchange for spot crypto trading. If you speak to anyone who’s been in crypto for over a year, then the chances are they have a Binance account.

Why is Binance so popular? It’s mainly due to:

- a huge array of altcoins available there

- deep liquidity

- and extensive exchange features.

But, despite this popularity, no one knows where Binance is headquartered. Yes, they have staff in around 50 countries and offices scattered around the world, but they don’t exactly have an HQ. Sure, some people might not like that. But, the likes of Coinbase, who are listed on the US Stock Exchange, don’t have a formal headquarters either. It’s more a sign of the changing times we are in, as people shift to more remote workforces.

Moreover, CZ, Binance’s founder, and one of the most prolific personalities in crypto isn’t exactly in hiding. Now, of course, this popularity does come with its downsides. It means that you become a target when regulators and governments are looking to make examples. Binance has recently been in the firing line of regulators and governments in recent months. Countries like China, Japan, Italy, Malaysia, Thailand, and the Cayman Islands have all recently imposed restrictions or issued legal proceedings against Binance.

The result of all this was Binance making sweeping changes to its KYC procedures, and while they are annoying for your average crypto trader, it was the most logical step for Binance to take to fall in line with global regulations.

Another thing you should know is that Binance holds a much bigger stake in the wider crypto ecosystem than just the exchange. Last year, they acquired the popular crypto card provider Swipe for a large sum of money. Then you have the acquisition of the top crypto price aggregator, Coin Market Cap for an astonishing $400 million, and the acquisition of Trust wallet back in 2018. In fact, Binance had even made an early-stage strategic investment in FTX.

FTX

Well, this global exchange was founded back in 2017 and they have an official headquarters in Hong Kong.

It also turns out that FTX has raised a crazy amount of money from venture capital funds as well. Earlier last year, they managed to raise an $900 million at an $18 billion valuation from over 60 different investors.

But how have they spent these newfound riches? Well, a bunch of that money was spent on acquiring new users and increasing FTX’s brand recognition via sponsorship deals. So, if the FTX has only popped up on your radar this year, you now know why.

But what sponsorships cost hundreds of millions of dollars? Well, FTX acquired the naming rights to esports organization TSM for $210 million, the naming rights to an NBA team stadium for $135 million, and for a lot of money a 5 year MLB sponsorship deal.

Then you have the celebrity endorsements like Tom Brady and supermodel Gisele Bundchen, who are also equity owners in FTX.

All that has propelled FTX to become the third biggest crypto exchange in the world, at least according to Coin Market Cap. That places it behind Coinbase. The main difference is that FTX has exploded out of nowhere, whereas Coinbase has been cemented as a top exchange for quite a while now.

Who are the brains behind the operation of FTX? Well, the exchange was incubated by one of the big-time crypto venture capital firms, Alameda Research. On top of that, many key personnel who work at Alameda also hold key positions at FTX, too.

OK, so that’s the high-level overview. But before you rush to sign up for either one of them, let’s brush up on your knowledge about their security. I mean, it is your crypto and your money at stake here.

Security

All right, I need to be straightforward here and let you know that Binance doesn’t have a spotless record when it comes to hacks. Yes, that is a problem that plagues many crypto exchanges, but you need to be aware of it. Back in 2019, around 2% of all the Bitcoin on the exchange got stolen by some nefarious hackers. They basically got access to Binance’s hot wallet.

We can also infer from this that Binance holds about 98% of all the crypto on the exchange in cold storage. So yeah, that hack was a letdown indeed. But, Binance did do the right thing and reimbursed everyone affected by that breach.

But what about security you can count on? Let’s look at Binance.

Binance’s Security

We wouldn’t want someone cracking into that after all. Well, Binance accounts are protected with a bog-standard password. However, you can further enhance that security by using a security key like a YubiKey to verify you are a human and not a remote attacker. Then you have security precautions like Google Authenticator which generates a 6 digit code which you’ll have to punch into Binance to log in or withdraw. This way, a crypto thief would most likely need to have your phone unlocked to get access to your account.

In terms of advanced security, you can also whitelist crypto addresses that you control. That way, a nefarious actor wouldn’t be able to withdraw from your Binance account for 24 hours, giving you time to lock everything down. On top of that, you can activate an antiphishing code. If that code you set up doesn’t show in a supposed e-mail from Binance, then you know it’s a fake e-mail and not from the exchange.

So that’s Binance, but how are things over there at FTX?

FTX’s Security

Well, I need to give credit where credit is due. FTX has got some of the most advanced security measures that I have ever seen. Yes, they offer you the option to secure your account with a password and two factor authentication, but if a crypto thief manages to get past all that, you can make their life even harder by setting a separate password to allow account withdrawals. A simple yet effective solution in my book.

Also, if anyone changes your password or unbinds your 2FA, withdrawals from your FTX account will be suspended for 24 hours, giving you time to regain control over that account. Another great thing about FTX is that if they detect any unusual activity, they’ll let you know over e-mail to make sure that it’s you accessing your account. In terms of whitelisting, FTX offers more options than Binance. Yes, you can whitelist wallet addresses, but you can also whitelist certain IP addresses so that your account is only accessible from home, for example.

On top of that, FTX won’t let big deposits or withdrawals go through without a second thought. Those types of transactions undergo manual review to make sure there’s nothing suspicious going on, which gives you another layer of assurance. So yeah, if you value a wide range of security options, then you might want to opt for FTX over Binance.

Now, even though security is super important, it means nothing if you can’t create an account or access the crypto assets that you want. Let’s look at both exchanges, country and asset support.

Country and Assets Supported

Now, Binance have not exactly made it easy to determine who can and cannot use the exchange. I have yet to find a definitive list from an official Binance source on blocked countries. But, Binance have said that they won’t be accepting users from Singapore after Singapore’s Central Bank claimed that the exchange was breaching local laws. Ontario residents in Canada are also unable to trade here due to a regulatory clampdown.

Earlier last year, when asked if Binance accepts Japanese users, the exchange declined to comment. So given the warning from regulators, I’d steer well clear of the exchange if you are based in Japan. It’s a similar situation for Thai users too. Thailand’s SEC filed a criminal complaint against Binance earlier last year for operating a business without a license.

Then you have China, which banned crypto transactions completely, so you’re out of the game if you live over there and don’t want to run the risk of getting into some serious trouble. Italian and Cayman Island residents should stay clear of Binance too, due to those regulators taking issue with Binance’s operations.

Now when it comes to US users, you’re out of luck if you want to use Binance.com. But, Binance.us could be an option for you.

Now I know the regulatory situation is shifting , so if you’re thinking of creating a Binance account, I would recommend that you do a quick Google search to check that there are no known problems in the country you live in.

But with all those potential pitfalls, you could be forgiven for being confused why Binance is still so popular. Well, one of the key reasons for that is the sheer variety of cryptocurrencies available on the exchange, around 400 at the last count.

Now, things are much more straightforward when it comes to FTX’s country restrictions. That’s because they have a list of countries they don’t support. It reads as an international naughty list, with the likes of Cuba, Crimea, Iran, Afghanistan, Syria, and North Korea all being blocked.

Users from Antigua and Barbuda or the USA are not allowed to create an account there either. FTX does have a dedicated US exchange FTX US.

When it comes to supported cryptocurrencies, FTX has a solid selection of around 250.

Anyways, let’s move on to the next most important consideration, and that is funding or withdrawal.

Deposit and Withdrawal Fees

Now, if you are fortunate enough to live in an exotic location with a funky currency, then I’m sure you know how frustrating it is to have to deposit on a platform with USD or EUR. You get ripped off with those foreign exchange fees. Well, the good news is that both Binance and FTX have excellent support for a host of different fiat currencies.

With FTX, all the currencies over here are supported and that is a great selection.

| Currency | Deposit | Withdrawal | Stablecoins | Instant interbank |

| USD | ✓ | ✓ | Many | Many |

| EUR | ✓ | ✓ | SEPA deposits | |

| GBP | ✓ | ✓ | ||

| AUD | ✓ | ✓ | deposits | |

| HKD | Soon! | Soon! | ||

| SGD | Soon! | Soon! | ||

| TRY | FTXTR | FTXTR | TRYB | Soon! |

| JPY | FTXJP | FTXJP | ||

| ZAR | Soon! | Soon! | ||

| CAD | ✓ | ✓ | ||

| CHF | ✓ | ✓ | ||

| BRL | ✓ | ✓ | ✓ | ✓ |

| ARS | ✓ | ✓ | ||

| GHS | ✓ | ✓ | ✓ |

But Binance smashes that out of the park with support for dozens of different currencies. That includes currencies that I don’t know the abbreviation for.

Now, when it comes to deposit methods, FTX supports the good old fashioned bank transfer. Binance, meanwhile, has a wider range of deposit options, including credit and debit cards and P2P trading.

But, with both exchanges, I’d recommend you use bank deposits as the way to get fiat onto the exchanges. This method is free and other methods will incur a hefty deposit fee, which you want to avoid. While we are talking fees, though, those that are likely to impact on your bottom line the most are trading fees. Let’s look at how these stack up.

Trading Fees

Now with crypto exchanges, there are two types of trading fees. The first are called taker fees, which are paid when you execute an order at the current market price. The second is as a maker fee, which is payable when you provide liquidity by placing things like a limit order. An example of that order type would be when you decide you don’t want to buy Bitcoin at $35,000 and instead want to get it at $20,000. Well, you can submit that order to the order book, which makes liquidity. If Bitcoin plunges to that price level and your order is triggered, then you’ll end up paying a maker fee on that trade.

Now at Binance, the highest maker and taker fees you’ll pay are 0.1%. Sure, you can get further discounts if you trade a ton, but how many of us are going to do more than 50 BTCs worth of trading volume in a month? Few, I bet, but there are other ways to further reduce those fees. If you use Binance’s BNB coin to pay fees, you’ll get a whopping 25% trading fee discount.

Binance Fee Rate / Spot Trading

| Level | 30d Trade Volume (BUSD) | and/or | BNB Balance | Maker / Taker | Maker / TakerBNB 25% off |

|---|---|---|---|---|---|

| Regular User | < 1,000,000 BUSD | or | ≥ 0 BNB | 0.1000% / 0.1000% | 0.0750% / 0.0750% |

On July 6, 2022 Binance launched zero-fee Bitcoin trading:

To celebrate Binance’s fifth anniversary, Binance will introduce zero-fee trading for BTC spot trading pairs at 2022-07-08 14:00 (UTC). The zero-fee trading will cover the following 13 spot trading pairs: BTC/AUD, BTC/BIDR, BTC/BRL, BTC/BUSD, BTC/EUR, BTC/GBP, BTC/RUB, BTC/TRY, BTC/TUSD, BTC/UAH, BTC/USDC, BTC/USDP and BTC/USDT.

Validity Period: 2022-07-08 14:00 (UTC) until further notice

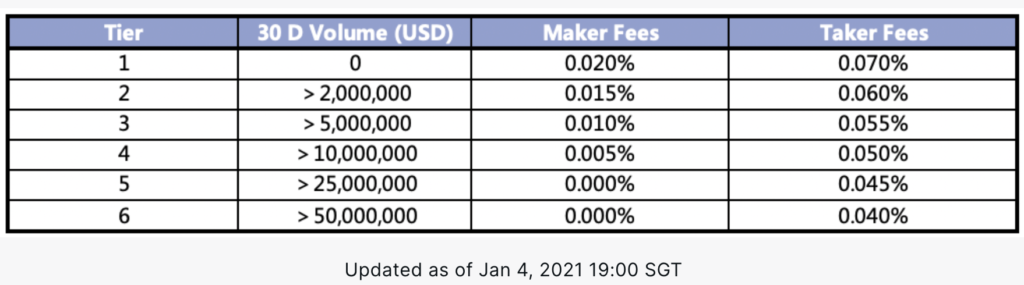

But fees on FTX are competitive too. Unless you’re trading more than $2,000,000 every 30 days, you’ll be paying 0.07% in taker fees and a mere .02% in maker fees.

FTX Trading Fees

FTX has a tiered fee structure for all futures and spot* markets, as follows:

So, if you think you are going to be placing a lot of limit orders, then you’re better off using FTX with those rock bottom maker fees on offers. Of course, there are a few tips here as well to reduce your training fees by holding FTT tokens, you can get an extra trading fee discount.

So now that you know how to optimize those trading fees, I want to move on and share with you the trading platforms at these exchanges.

Trading Platforms

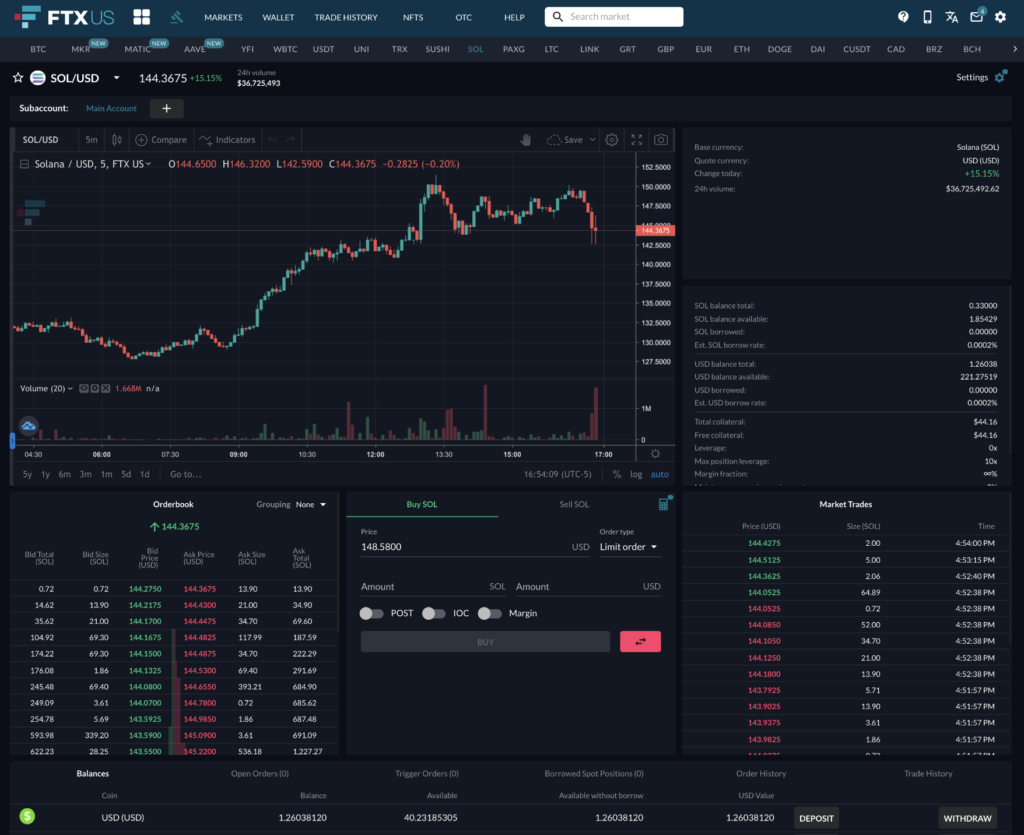

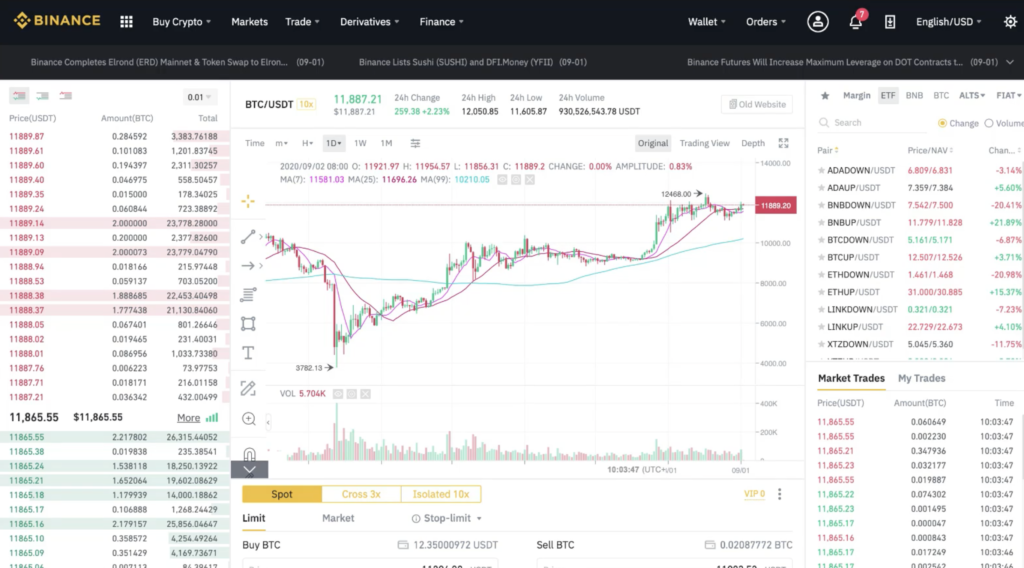

I’m going to be straightforward here and say. There’s too much separating the trading panels at either exchange. They are both great in my book and have very similar functionality. You have Binance over here and you can check out FTX below that. Yes, I know that these trading interfaces might look complicated if you’re new to crypto, but I can assure you they are quite straightforward to use once you know how.

OK, so that’s all well and good, but what if you need some help at a crypto exchange and you need to reach out to customer support?

That’s something to consider ahead of time, as trust me, the difference between good and bad support becomes clear when you need to use it. Yes, I am looking at you Coinbase…

Customer Support

Binance is one of the few exchanges out there that offers a form of live chat support. Now this sounds great, but, whenever I’ve reached out it did take a bit of time for support agents to get back to me. The good news is that you’ll get an e-mail when the folks at Binance do get back to you, and who knows, you might be luckier than me in terms of those responses.

FTX offers e-mail ticketed support, but you can also reach out to FTX on a plethora of different social platforms. I found their admins over there to be responsive.

So, which do I prefer? Well, I would give Binance a slight edge here.

Now, the truth is that FTX and Binance offer a heck of a lot more than buying and selling crypto. Let’s take a quick look at what else these exchanges have got.

Other Features

So, I’m sure many of you are aware of the meager rates of interest available at your friendly local bank. Well, both exchanges offer you a better deal if you want to earn higher rates of interest with your crypto.

FTX offers you the opportunity to earn 10% interest through its margin lending platform.

Whereas Binance offers some access to crazy crypto APYs through Binance Earn. High yield interest products are also available. But, I need to make it clear that you are accepting more risk if you choose to go down that path.

Another hot feature is Binance’s crypto visa card that allows you to spend those crypto gains wherever visa is accepted, and you can earn up to 8% cash back too.

Another cool feature is the Binance Launchpool. This allows Binance users to get new token rewards in return for staking certain cryptocurrencies.

Now, some projects don’t launch via public sale, or an initial exchange offering and instead opt to have their tokens distributed by the launch pool. So yeah, this is a way for you to get exposure to new projects at an early stage.

Then you have the legendary Binance Launchpad, which is Binance’s exclusive initial exchange offering platform. So yeah, if you want to access early-stage projects then you’ll want to check that out.

When it comes to NFT marketplaces, both exchanges offer one, but I’m going to level with you. Binance is more fleshed out when it comes to NFT availability, so bear that in mind if NFTs floats your boat.

So, what does FTX offer that Binance doesn’t? Well, recently Binance stopped supporting tokenized stocks, but FTX still has these. So, if you want to buy and sell the likes of Alibaba, Tesla, Amazon, Apple, etc. You can do that over there.

FTX also has some interesting prediction markets. These allow you to speculate on things like if Trump will become the next president in 2024. Here you’re trading futures contracts, which expire at $1.00 if Trump wins and $0.00 if he loses. So, some of you might like to take a punt on that action.

Another cool feature offered by this exchange is something known as the quant zone. This tool allows you to automate your trading strategies. That way you don’t need to be sitting at your computer all day to catch those market swings.

And finally, I should point out that both exchanges offer access to futures and other leverage instruments. But, I would tell you to steer well clear of these. That is because leveraged trading is risky and often, the cards are stacked against you.

Final Thoughts

We covered a lot of ground in this post. I sincerely hope this will help you pick the best cryptocurrency exchange based on the information provided.

What is the best crypto exchange in your opinion outside the two mentioned? Do you have any questions?

You can an additional 5% discount on all your trading fees at FTX.US if you sign-up via this link.