Today, we are going to discuss 5 fun facts about passive income investing as it relates to dividend investing. Now, when it comes to passive income, I have made it my personal life goal to make my passive income cover all of my major living expenses, like my house, my food, and my car. This is my long-term goal and I am sticking to it. It’s one of the many strategies I use toward achieving financial independence.

My Dividend Portfolio

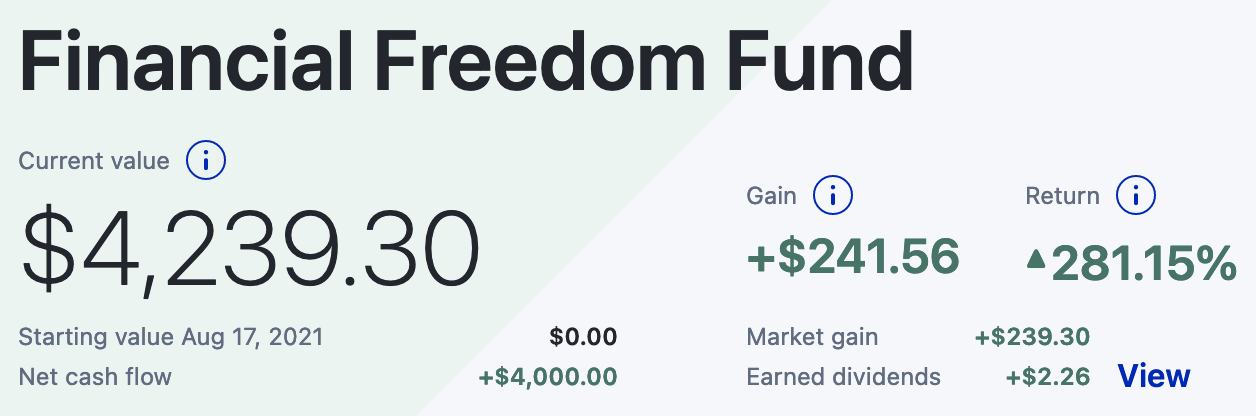

I started building my dividend income portfolio with M1 Finance in August. Right now it’s worth about 4,200 dollars. Of course, it’s too far away from achieving the dream of living off of passive income in the form of dividends. However, I am contributing to this investment strategy regularly and as you will see below, it justifies why starting early is crucial in growing one’s wealth.

If you are curious to know what my portfolio looks like for dividend investing, check out this link. If you sign-up through this link and fund your account with $100, we both will get $10.

Now, let’s get started!

5 Fun Facts About Dividend Investing

#1 Dividend Investing has accounted for a huge percentage of the growth in the entire stock market.

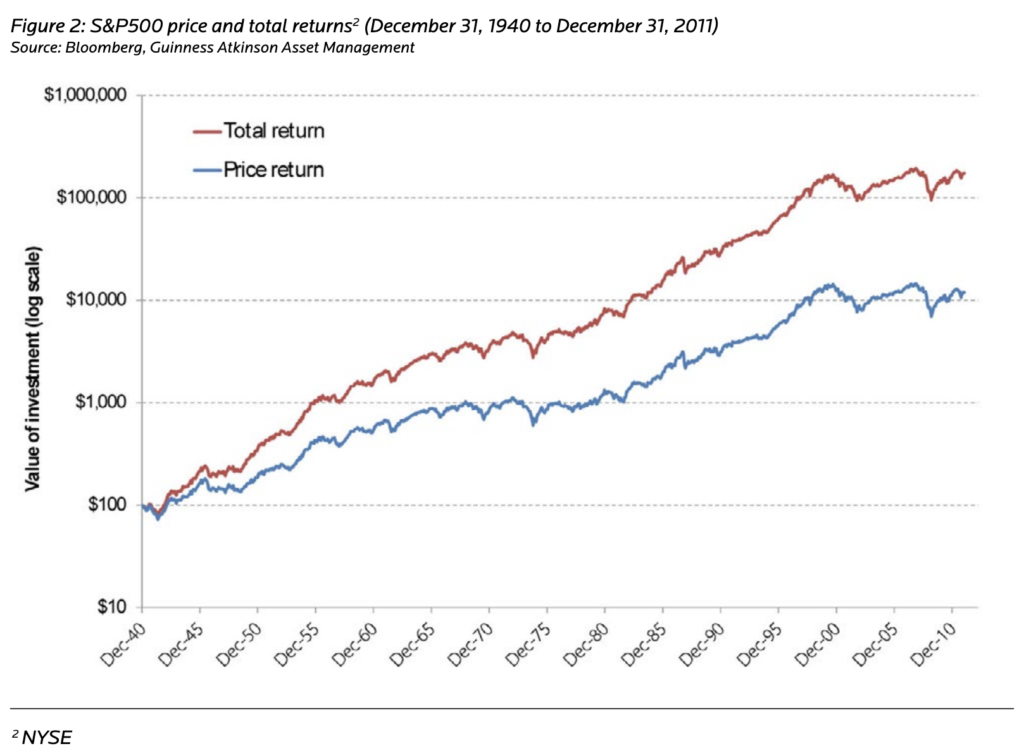

Check this out! In a study, called INVESTING IN HUMAN PROGRESS WHY DIVIDENDS MATTER by Dr. Ian Mortimer and Matthew Page, CFA Fund Co-managers, when looking at the long run of the S&P 500 historical return since 1940, they concluded that reinvested dividends have accounted for over 90% of the index’s growth during that time.

Just think about that for a second! Reinvested dividends have accounted for over 90% of growth in the stock market since 1940!

The truth here is that long-term dividend investing is a guaranteed way to grow wealth without fearing the volatility of markets short term and

If you had invested $100 at the end of 1940, this would have been worth approximately $174,000 at the end of 2011 if you had reinvested dividends, versus $12,000 if dividends were not included.

— Dr. Ian Mortimer and Matthew Page, CFA Fund Co-managers

What a crazy big difference this $100 makes! I hope, now, you understand why I am investing in dividend-paying stocks!

This is exactly why personally I reinvest every single dollar that I get from my dividend investing portfolio back into itself every month.

If we look at low growth periods such as the 1940s and the 1970s, even then still, reinvested dividends have accounted for over 75% of this stock market returns.

#2 Dividend companies fall less hard during recessions and they recover a lot quicker.

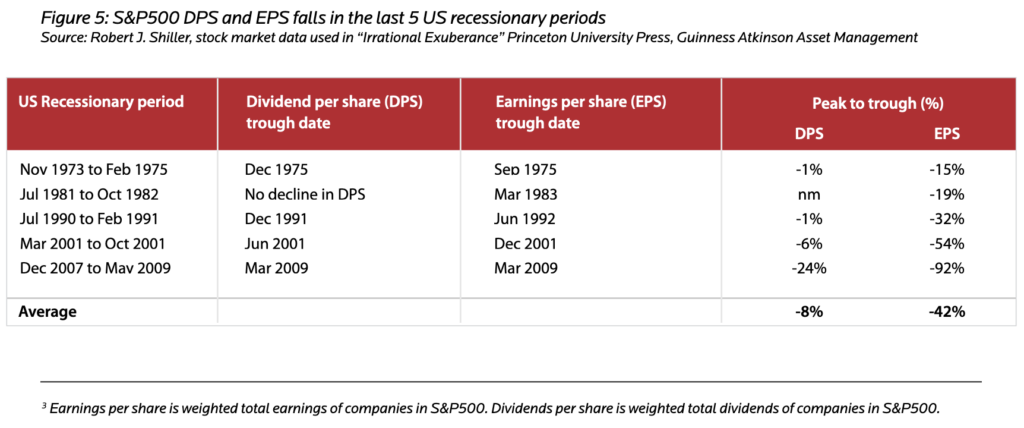

So, here are some recessions to illustrate this exact point:

- November 1973 to February 1975: dividends per share DPS fell 1% in comparison to earnings per share or the EPS that fell 15%.

- July 1981 to October of 1982: there was no decline in dividends per share while earnings per share fell 19%.

- From 1990 to 1991: dividends per share fell just 1% and earnings per share fell 32%.

- From June 2001 to December 2001: DPS fell 6% and EPS fell 54%.

- The most recent recession, the housing bubble of 07 and 08, DPS fell 24% in comparison to EPS falling 92%.

Why the dividend-paying companies are so special and what makes them so protected during economic recessions? It’s true, that some companies can and absolutely do freeze or cut their dividend entirely during hard times, but rarely do they ever cut their dividend dramatically all at once. And that’s because a dividend represents a company’s future earning power. It’s supposed to be set at reasonable payout levels that are sustainable no matter what the market conditions are.

Another factor that helps this cause is that many dividend investors love to use those dividend payouts to buy more high-quality dividend-paying companies for less.

#3 Profits are a matter of opinion and dividends are a matter of fact.

Now, some companies have been known to make it seem like they’re a lot more profitable than they actually are, and there are a lot of different creative ways that a company can do this.

Share prices in the stock market are not always super accurate and reflective of the truth. That means if a company is not paying dividends and it’s just a growth company that makes it a little bit more difficult to assess just how profitable that company really is. We have to trust the CEO and the company reporting its own profitability and hope that they are not lying to us. It’s just that simple, as a dividend investor, I know that each and every dividend that I receive is 100% real.

It’s coming from real profitability and it’s a real dollar. It cannot be manipulated by creative accounting to make it seem like a company’s profitable if it actually isn’t.

#4 Dividend paying company will pay you the same amount on the basis on which you bought.

It means that if you put in a hundred dollars into a company that’s paying you four percent it’s going to pay you that four dollars regardless of what the share price is worth, whether it’s half or double, assuming the company doesn’t freeze or cut its dividend altogether. This one simple fact gives me all the confidence I need to continue investing more money into dividend-paying companies.

#5 Dividends are an inflation hedge.

When looking at the S&P 500 dividend growth rate over a ten-year rolling period since the 1940s we get a 6% dividend growth rate in the last ten years. And that is amazing because when looking at inflation over the same period of time, that is 4%, so your dividend growth rate is growing faster than inflation, protecting your dollar from losing its purchasing power.

Investing in divided paying companies can, over the long term, provide an inflation hedge, in the sense that the income received in the form of dividends grows in line (or often at a higher rate) than inflation.

– Dr. Ian Mortimer and Matthew Page, CFA Fund Co-managers

If you want a TLDR version of this topic, then it’s super simple — long-term dividend investing pays off huge!